Our Process

Paraiba navigates constantly changing market conditions by using top down asset class views throughout the market cycle, and implements tactical views to take advantage of short term opportunities and dislocations. Our actively managed investment strategies combines independent thinking with a disciplined, rules-based investment approach. We can utilize a broad range of potential investments across various asset classes, strategies and styles. Asset classes can include cash, US and global fixed income and equities and alternative assets such as real estate, precious metals and commodities.

We believe in a focused approach to investing. Our actively managed portfolios are diversified, but concentrated in high conviction investments using our risk management approach to help lock in gains and limit losses; approaches typically ignored by mainstream advisors. Paraiba works to ensure your investment portfolio is optimized through continuous monitoring, dynamic asset allocation and opportunistic rebalancing.

When working with you, we consider your objectives, risk tolerance and review your portfolio regularly to ensure it continues to align with your objectives.

A Focused Approach to Investing

A concentrated equity portfolio is distinct from the typical managed portfolios in that it is generally focused on a portfolio manager’s “best ideas.” We outline the significant differences that result from holding fewer positions. In a concentrated portfolio, the manager intentionally limits the number of holdings, resulting in each holding carrying more weight compared to funds and strategies that hold many more positions, i.e. 100 to 200. For example, in an equally weighted portfolio, composition may be as follows:

- A concentrated portfolio with 25 holdings allocates 4% to each position

- A portfolio with 200 stocks allocates 0.5% to each position

More often, in portfolios that hold a larger number of holdings, managers maintain a higher weighting in stocks they believe have the most potential and then add smaller positions. These positions are minute for any number of reasons, i.e., they may be less desirable, have less growth potential or may be an emerging opportunity. Nevertheless, rather than contributing to alpha, these small stock positions can act as a distraction to a manager and dilute performance. In “Best Ideas,” researchers Randolph B. Cohen, Christopher Polk, and Bernhard Silli describe these portfolios that hold numerous stocks as containing a “few core high conviction positions – the best ideas – and then a large number of additional positions which may have less expected excess return but which serve to ‘round out’ the portfolio.”

Concentrated Yet Diversified

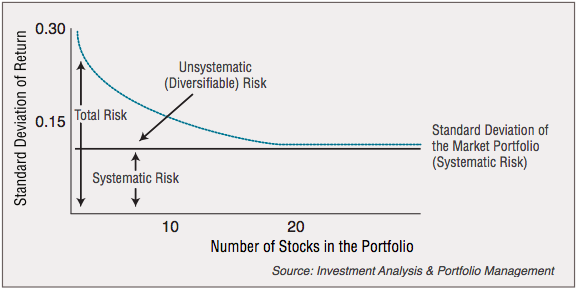

In “rounding out” the portfolio, it has been assumed by mainstream advisors that only a portfolio with a larger number of holdings can be fully diversified and, therefore, less volatile. Yet research shows diversification can also be obtained with a much smaller number of holdings. Finance textbook Investment Analysis & Portfolio Management highlighted the classic 1968 findings of John Evans and Stephen Archer along with Thomas Tole’s 1982 research which demonstrated that “90 percent of the maximum benefit of diversification [was] derived from portfolios of 12 to 18 stocks.” Further, as the number of holdings increased to approximately 20, a gradual reduction in portfolio risk occurs.

While a portfolio of one holding yields the highest standard deviation, the standard deviation rapidly declines as more stocks are added. To obtain the same level of risk as the market – known as systematic risk – 20 stocks was considered to be the minimum number of holdings. As the portfolio adds holdings after this level, standard deviation mostly levels off to that of market risk.

As a result, concentrated portfolios have been found to offer approximately the same level of portfolio risk as portfolios with twice the number of holdings. With risk being relatively the same as broad-based funds, several research studies have found that a noticeable benefit of concentrated portfolios is outperformance.

Researchers from Emory University, Klaas P. Baks, Jeffrey A. Busse, and T. Clifton Green, agree that there is a positive relationship between performance and a manager’s conviction in their best ideas. As stated in their paper, “Fund Managers Who Take Big Bets: Skilled or Overconfident?” they found “focused managers outperform precisely because their big bets outperform the top holdings of more diversified funds.” Analyzing actively managed US domestic equity funds, they focused on a stock’s position in the portfolio as a measure of the fund manager’s level of optimism relative to other securities. Based largely on the portfolio holdings and managers’ willingness to “take big bets in a relatively small number of stocks,” they determined that concentrated managers outperformed their non-concentrated counterparts by about 4% annually.