We’re living through the biggest economic shift since the Industrial Revolution. AI is reshaping entire industries—creating new market leaders while established players face decline.

This creates a fundamental problem for passive investors. By design, index funds are backward-looking. They are market-cap weighted, meaning they are over-exposed to yesterday’s winners. As the future takes shape, passive investors risk being left behind, holding onto the past.

Conviction Over Conformity

So, how do you invest in tomorrow’s leaders today? You follow the smart money.

Our strategy begins by studying the “whales”—institutional investors who conduct meticulous, deep-dive research before making significant moves. We decode their accumulation patterns to see where conviction is building long before it becomes common knowledge.

This data-driven insight allows us to build our own high-conviction positions in game-changing companies poised for long-term growth.

Discipline and Patience

This approach is grounded in discipline, patience, and evidence. Real investing isn’t about chasing short-term trades. It’s about:

In today’s market, active management isn’t just an option. It’s a necessity.

How the Ultra-Wealthy Invest

We leverage the same playbook as family offices and ultra-high-net-worth investors, relentlessly targeting tomorrow’s market leaders—companies with durable moats, strong free cash flow, and disruptive potential.

Concentrated Conviction

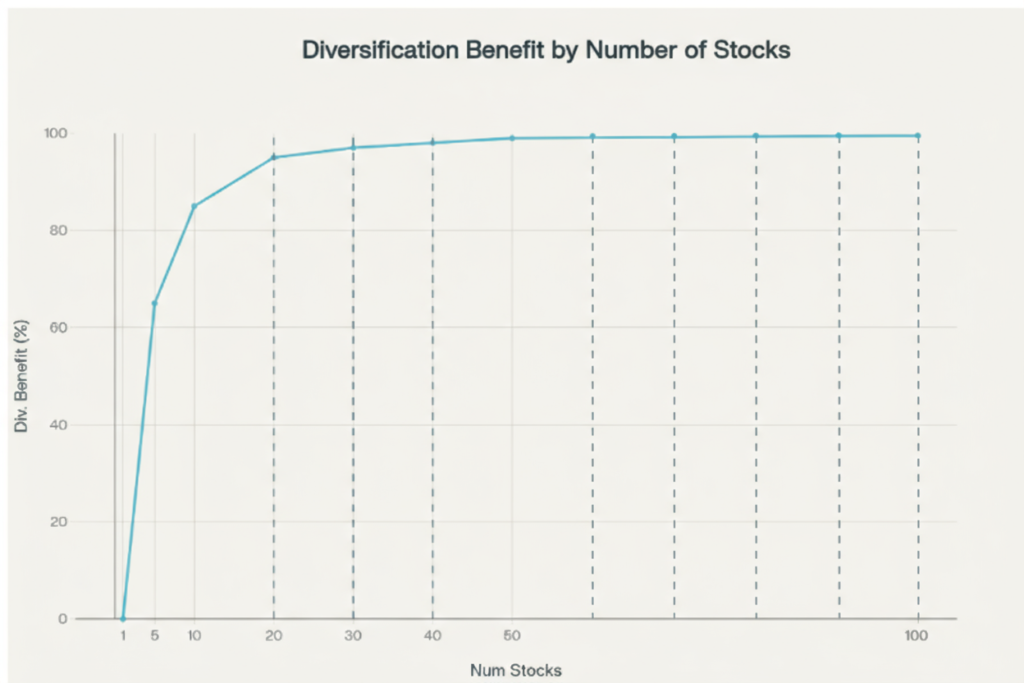

True diversification isn’t owning hundreds of names—it’s focusing on 12–18 high-conviction stocks uncovered through rigorous research. This concentrated approach is what gives us a real edge over passive indexes.

Identifying Tomorrow’s Leaders

Backward-looking metrics can’t predict innovation. We dig deeper, screening for:

Downside Discipline

We use tactical risk management and look to reduce exposure before downturns and redeploy capital at market troughs—preserving gains and maximizing compounding.

Customized for You

Your goals, risk tolerance, tax needs, and income requirements shape your portfolio. We build and actively manage a strategy that evolves with your life.

Your Assets: Secure and Accessible

Your assets are held in your name at a major, independent custodian like Charles Schwab. You always have direct, 24/7 access to your accounts with full transparency.

What can you expect when you work with us? A relationship built on three core commitments.

1) Advice That Puts You First

Our relationship is guided by a simple promise: your best interest comes first. As your fiduciary, we’re legally and ethically bound to provide objective and conflict-free advice tailored to you.

2) A Plan as Unique as You

Your financial journey is unique, and so is our guidance. You’ll receive actionable advice designed to give you clarity and help you get ahead.

3) Portfolios Built for Real-World Results

We don’t believe in a “set-it-and-forget-it” approach. We constantly monitor market dynamics and company performance, assessing their direct impact on your portfolio. This allows us to make strategic adjustments when opportunities or risks emerge.

Who We Partner With

We specialize in working with clients who have done the hard work of building their nest egg (typically $500,000 or more in investable assets) and are seeking a proactive approach to growing and protecting their wealth.

A Focus on Modern Retirement

We see retirement as a new chapter, not an endpoint. We focus on building portfolios that grows your wealth for a future that could span decades.

A Straightforward Fee Structure

Our transparent fee aligns our success with yours. No hidden costs. No surprises.

Our fee is calculated as an annual percentage of the assets we manage and billed quarterly:

Passive Indexing

Owns all stocks (winners and losers) |

Weighted toward yesterday’s leaders |

Rides out every market downturn |

Rebalances only 1-2 times per year |

Our Active Approach

| Concentrated holdings in 25-30 top opportunities |

| Positioned for tomorrow’s market leaders |

| Adapts to protect capital during volatility |

| Continuous monitoring and optimization |

Our relationship is built on a simple principle: your interests always come first. As your fiduciary, we are legally and ethically obligated to provide objective guidance tailored exclusively to your financial life. No conflicts, no hidden agendas. Just transparent advice.

Your financial journey isn't a template, and neither is our guidance. You’ll receive actionable advice designed to give you clarity and help you get ahead. This is a proactive partnership, built to ensure you don’t settle for average.

We don’t believe in the "set-it-and-forget-it" approach. Real progress demands active management. We constantly monitor market dynamics and company performance, assessing their direct impact on your portfolio. This allows us to make strategic adjustments when opportunities or risks emerge. We don't just rebalance; we optimize.

What can you expect when you work with us? A relationship built on three core commitments.

1) Advice That Puts You First

Our relationship is guided by a simple promise: your best interest comes first. As your fiduciary, we’re legally and ethically bound to provide objective and conflict-free advice tailored to you.

2) A Plan as Unique as You

Your financial journey is unique, and so is our guidance. You’ll receive actionable advice designed to give you clarity and help you get ahead.

3) Portfolios Built for Real-World Results

We don’t believe in a “set-it-and-forget-it” approach. We constantly monitor market dynamics and company performance, assessing their direct impact on your portfolio. This allows us to make strategic adjustments when opportunities or risks emerge.

Who We Partner With

We specialize in working with clients who have done the hard work of building their nest egg (typically $500,000 or more in investable assets) and are seeking a proactive approach to growing and protecting their wealth.

A Focus on Modern Retirement

We see retirement as a new chapter, not an endpoint. We focus on building portfolios that grows your wealth for a future that could span decades.

A Straightforward Fee Structure

Our transparent fee aligns our success with yours. No hidden costs. No surprises.

Our fee is calculated as an annual percentage of the assets we manage and billed quarterly:

Who We Partner With

Our clients have already done the hard work of building their nest egg. We typically partner with investors who have accumulated $500,000 or more in liquid assets and are ready to move beyond passive, “average” returns.

A Focus on Modern Retirement

Retirement isn’t an end point—it’s a new chapter in your growth story.We specialize in building portfolios that balance the need for reliable income with the necessity of long-term growth, recognizing that modern retirement can span decades.

Your Assets: Secure and Accessible

Your assets are held in your name at a major, independent custodian like Charles Schwab. You always have direct, 24/7 access to your accounts with full transparency.

We don’t believe in one-size-fits-all investing. That’s why your portfolio is crafted around your goals, timeline, and risk comfort—not some template.

Got RSUs, ESPPs, or other employer benefits? We’ll help you get the most value out of them—while avoiding unexpected tax headaches.

We’ll help you craft a retirement plan that’s uniquely made for you. Whether it’s timing your Social Security benefits, saving strategies or smart withdrawal strategies, we’ll make sure your money works for you, today and tomorrow.

Living abroad or juggling international assets? Whether it’s international accounts or tax treaties, we break down the complex stuff into clear next steps.

Let’s chat. We’ll dig into what you want, what keeps you up at night, and whether we’re a good fit. No pressure, just real talk.

Using what we’ve learned, we’ll design a personalized strategy tailored to you. Our portfolios are customized and designed to access all asset classes—including stocks, ETFs and bonds.

Life changes, and so will your plans. We’ll adjust your financial plan so it always stays aligned with you—no matter what the markets or life throw your way.

Your investments, safely managed

Your investments are managed by CERTIFIED FINANCIAL PLANNERS™ and seasoned advisors who keep a close eye on your portfolio, while making sure it’s aligned with your goals and values.

For added security, your assets are held with trusted third-party custodians like Charles Schwab. This means you’ll always have quick and easy access to your money whenever you need it.

More clarity, less confusion

Working with us means ditching the financial guesswork. We’ll break down complex topics such as taxes and retirement into plain English, so you always understand what the plan is.

Book your complimentary strategy session.

Here’s what we’ll cover:

→ Analyze your current portfolio and uncover opportunities

→ Show you how active management works

→ See if you’re a fit for our approach

Get real insights and actionable advice delivered to your inbox.

Copyright © 2025. Paraiba Wealth. All rights reserved.

Before making any financial decisions, you should seek guidance from a qualified financial, tax, or legal advisor who understands your individual circumstances. This content is provided solely for informational and educational purposes and is not intended as an offer or solicitation to buy or sell securities. Any references to rates of return are drawn from past performance or hypothetical scenarios and do not promise future gains.

Past performance does not guarantee future performance. Returns in the future could be higher or lower than those in the past. Investing comes with inherent risks, including the potential loss of your initial investment. The value of investments can shift with changing market conditions, and when securities are sold, they may be worth more or less than your original cost.