Over-diversification leads to mediocrity. When you own everything, you end up owning mostly nothing that truly drives returns—yet you still endure every market downturn without the flexibility to respond.

There’s no active management, no strategic adjustments—just a commitment to weather the storm, no matter how long or severe.

At Paraiba Wealth, we believe your retirement deserves more than one-size-fits-all index funds.

We actively manage focused stock portfolios with one goal.

Protect your downside while actively investing to grow and compound your wealth.

| Criteria | Traditional RIA Approach | Paraiba Wealth’s Approach |

| Asset Allocation | One-size-fits-all model portfolios of broad, passive index funds (dozens), rebalanced annually; clients pay fund expense ratios plus AUM advisory fees while downside protection limited to fixed-income or cash allocations | Concentrated portfolios of 12–18 stocks selected via deep research and thematic analysis; portfolios include tactical overweights and dynamic risk overlays for downside protection |

| Focus | Broad asset-class diversification with static weightings and minimal differentiation or potential to outperform | Rigorous bottom-up stock selection targeting mispriced or high-growth companies; active management driven by proprietary research, market signals, and downside protection to preserve capital in volatile markets |

| Portfolio Construction | Off-the-shelf index-fund portfolios with advisory fees layered on top; downside defense relies on static bond weights | Custom-built, actively managed portfolios, monitored via ongoing research and proactive management to capture opportunities, with active risk-management tools in place |

| Customization | Limited to choosing predefined risk models (e.g., conservative, moderate, aggressive) | Fully bespoke portfolios aligned to each client’s goals, tax profile, time horizon and concentrated-position needs, ensuring strategies match individual circumstances and retirement plans |

| Management & Expertise | Mostly template-based management and passive portfolio maintenance | CFP-led, institutional-grade equity research with deep due diligence, disciplined trade execution, integrated financial planning, proactive tax management, and drawdown mitigation for a holistic, life-plan–driven wealth strategy |

You’re told to buy the index, diversify and hope for average.

But in a world of constant change, average means stagnation.

What they don’t tell you is that true conviction isn’t diluted across hundreds of names.

It’s focused and concentrated.

Research from Paul Woolley Centre shows that more concentrated portfolios outperformed their more diversified counterparts over 1990–2009.

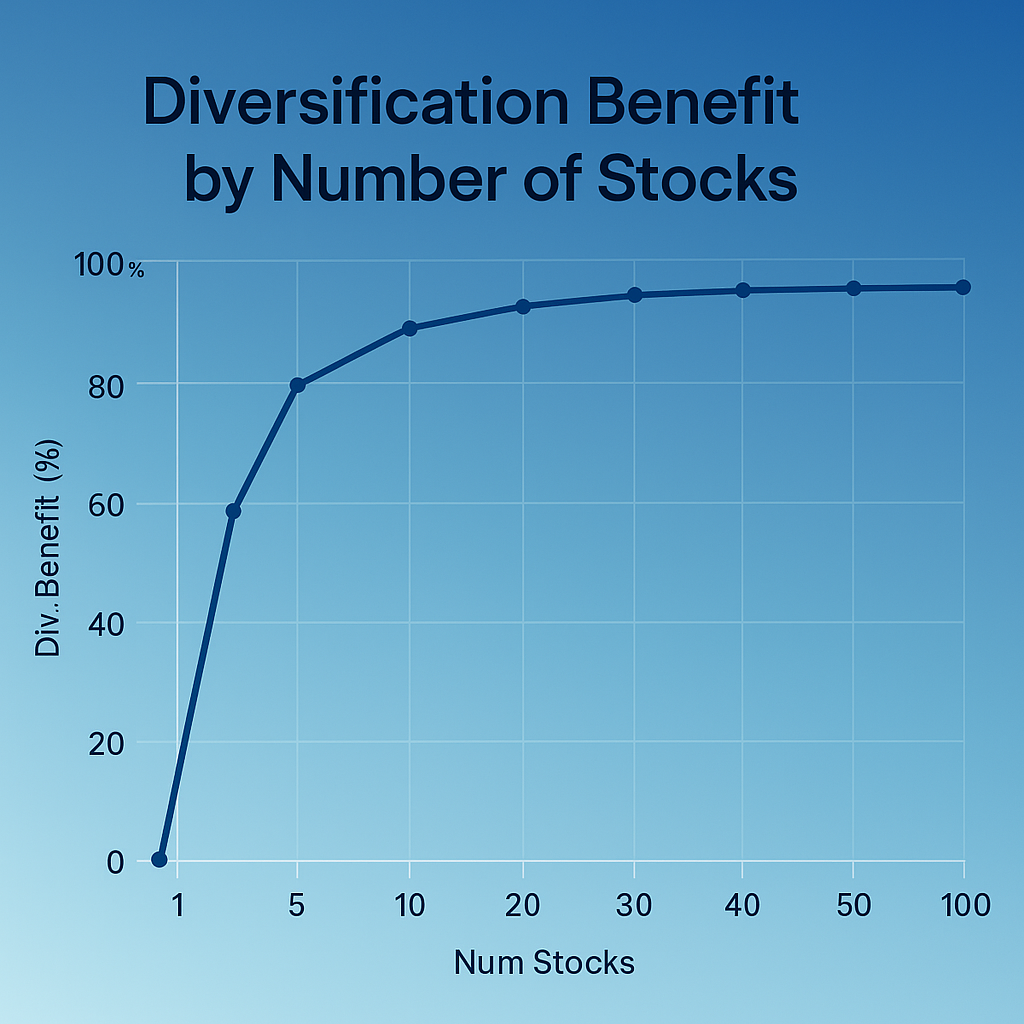

Beyond 30 stocks, the benefits of diversification vanish. You don’t gain more value from diluted returns, hidden fees, and a portfolio that looks like everyone else’s.

You become a passenger, not a driver.

The real edge isn’t in owning everything. It’s in owning the right things. The few that create immense value.

1) High-Conviction Long-Term Stocks

We don’t simply buy a basket of index funds and hope for the best.

Instead, we do deep research and analyze individual companies, investing with a multi-year horizon, focusing on those with:

We don’t believe in blind diversification and owning hundreds of mediocre businesses; we invest using intelligent concentration.

Each position in our client portfolios is a high-conviction investment—companies we believe will compound wealth over multiple market cycles.

2) Proactive Portfolio Management

Most advisors review your portfolio twice a year, rebalance, and call it a day.

We operate differently.

We monitor market conditions not annually, not quarterly, but daily. It’s about understanding shifts before they become trends.

We use dynamic position sizing to align risk with reward.

3) Integrated Financial Planning

We see your investments as one part of a larger picture.

That’s why we don’t just manage a portfolio—we build a holistic financial plan that coordinates all aspects of your wealth, including:

Every piece of this plan is designed for one clear mission: funding the retirement you actually want, not just the one you settle for.

Most people have never heard of a Paraíba tourmaline.

That’s exactly the point.

Deep in Brazil’s remote mountains, miners spend years searching for something most will never find: a gemstone that radiates an electric blue-green.

Paraíba tourmalines are 10,000 times rarer than diamonds. But rarity isn’t what makes them valuable—it’s their refusal to blend in.

This isn’t just a metaphor. It’s our blueprint.

While most advisors chase safety in passive index funds—content to be part of the crowd—we carve a different path.

Relentless research. Intentional hand-picking of every stock position.

And active, ongoing management to make sure your portfolio stays ahead, adapting as markets evolve.

Because we believe your wealth isn’t meant to be average.

Book your complimentary strategy session.

Here’s what we’ll cover:

→ Analyze your current portfolio and uncover opportunities

→ Show you how active management works

→ See if you’re a fit for our approach

Get real insights and actionable advice delivered to your inbox.

Copyright © 2025. Paraiba Wealth. All rights reserved.

Before making any financial decisions, you should seek guidance from a qualified financial, tax, or legal advisor who understands your individual circumstances. This content is provided solely for informational and educational purposes and is not intended as an offer or solicitation to buy or sell securities. Any references to rates of return are drawn from past performance or hypothetical scenarios and do not promise future gains.

Past performance does not guarantee future performance. Returns in the future could be higher or lower than those in the past. Investing comes with inherent risks, including the potential loss of your initial investment. The value of investments can shift with changing market conditions, and when securities are sold, they may be worth more or less than your original cost.